How Many Product Options Should Customers Have?

In today’s world, you can order your coffee in a number of different sizes: small, medium, large, short, tall, grande, venti, or even in a 31-ounce trenta. Add in fancier options, such as lattes and macchiatos, and you have a seemingly infinite number of choices for your morning cup of joe. In a generation of proliferating product choices, it seems a daunting task for manufacturers to develop a product portfolio that suits the needs of all of their customers. Which begs the question, how many products should manufacturers offer to their customers, and is more always better?

Blue Canyon was recently engaged by a leading hardware supplier to develop a growth strategy for its aftermarket business. The supplier performed exceptionally well in the new construction market, where architects would write specifications for its products to be installed in new buildings. However, the Great Recession brought new building construction to a halt, shifting the majority of hardware sales to the aftermarket. Multiple competitors entered the aftermarket and some began to sell imported products through their channels. The effects of the recession were compounded by the entrance of new competitors and private label imports. As a result, the client experienced a huge shift in channel partner and end customer loyalty away from its premium brand. To an increasing degree, installers were substituting our client’s “Best” product with competitors’ “Good” products.

This discovery presented a dilemma for our client. Was the quality of their Best product no longer enough to warrant a premium price? Why was their Better product being passed up for competitors’ Good options? Was there a need for a Good product to supplement their Better and Best products?

The Case for Limiting Options

While it is sometimes advantageous for manufacturers to offer a series of product choices, there are cases where it pays to limit options provided to customers. However, when is a “Good-Better-Best” product portfolio trumped by Good and Best options?

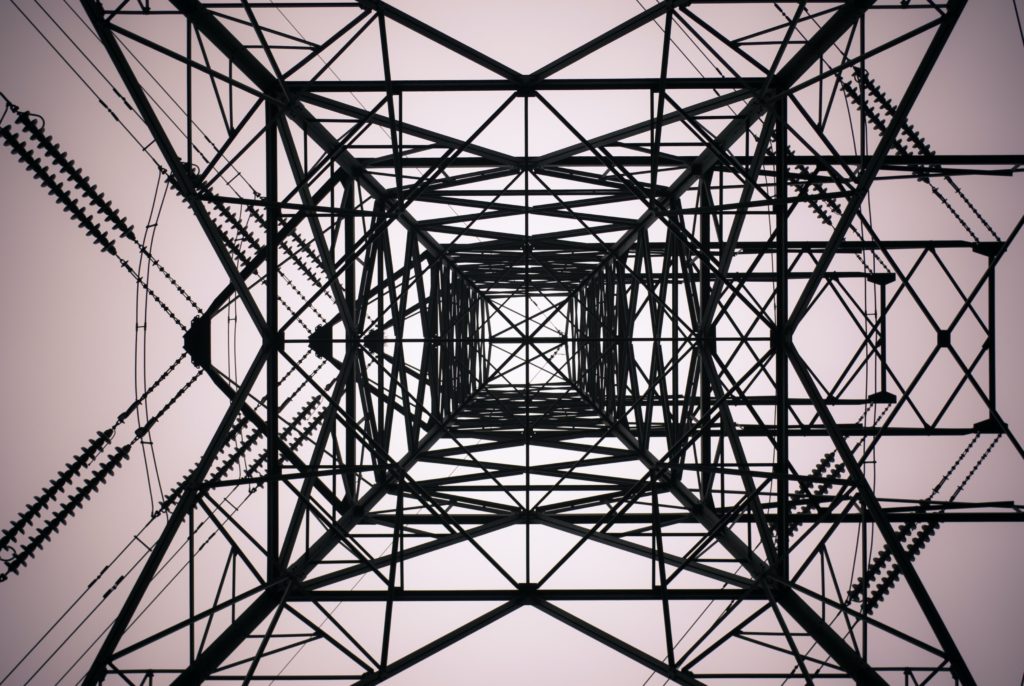

Good, Better, Best Market Map

In the above Good, Better, Best Market Map[1], the Good offering is designed for the upper right quadrant. These are cases where direct customers and end customers make purchase decisions based mostly on price. Good products typically offer a limited set of features and service options and are subsequently sold at a lower price point. The Best offering is designed for the lower left quadrant, where both direct customers and end customers make purchase decisions based on factors other than price. Best products typically offer superior features and services for a premium price point. The Better offering is designed for those cases where purchase decisions are based on a combination of price and other factors. Better products typically offer an intermediate level of features and service. In determining which offerings to provide to customers, manufacturers should consider the following:

- Is there demand for multiple product options at varying price points?

If there is a large segment of the market that demands the value proposition offered by that product tier, whether it be Good, Better, or Best, then manufacturers should offer that tier in their product portfolio. However, if the market does not demand the value proposition offered by a particular tier, the manufacturer should reconsider offering it. If the market demands Good and Best products to a large degree, the manufacturer should offer those options and reconsider the extent to which the Better option is offered. Better products will often be passed up when Good products are deemed “good enough” by the market. - Is there clear differentiation between the Good, Better, and Best tiers?

If a supplier adds a tier to their product portfolio but does not differentiate the features, functions, or services offered by that tier from other tiers, they risk cannibalizing their own product. For instance, if a supplier offers a Good product at a low price point in order to compete with importing competitors, but does not differentiate the features, functions, or services offered by their Good product from their Better product, customers will revert to making their purchase decision based on cost and will choose the Good option over the Better option. This results in decreased sales for the Better tier and decreased revenue overall. - Do sales incentives offered to channel partners increase along with the price of premium products?

Our client had not strategically structured the incentives offered to their channel partners to sell more of their premium product. In fact, channel partners had been receiving higher margins for selling imported products to end customers than the premium product that our client offered. Not only was the end customer getting a lower price with the Good option than with the Better option, but channel partners also had greater incentive to sell the Good option than the Better option. Good products will win out when channel partners are not incentivized to upsell.

As in the case of our building hardware client, market forces can shift the priorities of business customers. While some direct and end customers require Best products others view Good options as “good enough.” Yet others fall somewhere in between. Manufacturers should:

- Determine whether significant demand exists at each tier to justify offering that product category

- Differentiate product tiers by features, functions, or services to prevent cannibalization

- Strategically align channel partner incentives with the manufacturer’s interests in mind

[1] Brown, Jr. and Valentine Pope, CoDestiny: Overcome Your Growth Challenges by Helping Your Customers Overcome Theirs, Greenleaf Book Group Press, ©2011